calculate income tax malaysia

As per the Income Tax Act whatever professional tax an individual has paid during the last year is. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment.

Provision For Income Tax Definition Formula Calculation Examples

In this article we will go through the computerised method to calculate PCB accurately in four steps.

. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Situations covered assuming no added tax complexity. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

This is based on the number of days spent in Malaysia and should not. Guide To Using LHDN e-Filing To File Your Income Tax. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The easiest income tax calculator in Malaysia to use plus income tax guides to answer any income tax question you may have. Italy Jamaica Japan Kazakhstan Kenya Kosovo Laos Latvia Liberia Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Malaysia Maldives Malta Mauritius Middle East Region Middle East Bahrain Egypt Iraq Jordan Kuwait.

Nevertheless taxpayers shall continue to be qualified for a tax deduction for income tax received outside India per Sec. When it comes to the season of income tax in Malaysia thats when people tend to leave things till the last minute are you one of them and then make careless mistakes out of panic. With all that said heres an example of how to calculate your net rental income.

Tax Offences And Penalties In Malaysia. As discussed if youve bought and sold your property within 12 months your capital gain is simply added to your taxable income. Income Tax Slab Tax Rates in India for FY 2020-21 FY 2021-22 - Latest income tax slabs and rates as per the union Budget 2021 presented on February 1st 2021.

Estimate your personal income taxes in each province and territory with our Income Tax Calculator for Individuals. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method.

Guide To Using LHDN e-Filing To File Your Income Tax. How To File Your Taxes Manually In Malaysia. When the Income Tax Department underestimates the income and the consecutive due tax it takes special measures to calculate the amount of tax that should be paid.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. This section only applies if you want to calculate your income tax manually. Ensure you request for assistant if you cant find the section.

Calculate how much income tax you will be paying in 2022. Only certain taxpayers are eligible. After filling out the order form you fill in the sign up details.

How do I calculate capital gains tax. The income tax slabs and rates announced are applicable for the upcoming financial year. There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution.

Effective from FY 2022-23 gains from various virtual digital assets such as bitcoin dogecoin non-fungible tokens NFTs etc. A new section 115BBH has been inserted into the Income-tax Act 1961 for taxation of virtual digital assets. Will be taxed at a rate of 30 percent plus cess and surcharges.

10 Perkara Wajib Tahu Tentang Cukai Pendapatan LHDN 2 Knowing all the tax reliefs that you may be eligible for in 2022. Any amount paid outside India that is liable for tax exemption under Sec. Best Way to Calculate Your HRA House Rent Allowance Tax Slab Rates Saving Tips.

How to calculate annual income. Gross rental income Monthly rent. Recall employees status and information.

But for individuals who owned their property for longer than 12 months before selling it there are two different methods used to calculate CGT. Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C. Any State Government is not eligible to impose more than Rs2 500 annually as professional tax.

How to calculate taxes taken out of a paycheck. Best ways to save tax - Income Tax Saving Tips. The income tax slabs for a financial year are announced by the finance minister every year in the Union Budget.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Count your tax deductions to see if you save on taxes this year. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

How Does Monthly Tax Deduction Work In Malaysia. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 90 or income tax deduction under Sec.

Get your Life Goals Done with Bajaj Allianz Life Smart Assist BINA MILEY MIL-KAR. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. How To Pay Your Income Tax In Malaysia.

Tax Offences And Penalties In Malaysia. How To Pay Your Income Tax In Malaysia. Usually the finance minister makes an announcement in the month of February when the budget is announced and once the law is passed by the parliament it becomes.

91 is regarded to never have been allowable per Sec. How Does Monthly Tax Deduction Work In Malaysia. Tax Offences And Penalties In Malaysia.

As per the Income-tax Act every person must calculate and pay their due taxes. Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10 onwards. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes.

The student will be required to return all course materials. Guide To Using LHDN e-Filing To File Your Income Tax. The result is net income.

CTEC 1040-QE-2662 2022 HRB Tax Group Inc. 40 of the Income-tax Act. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Firstly fill in the values for the following employee information. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. How To Pay Your Income Tax In Malaysia.

By doing so you may receive a refund for some or. How To File Income Tax As A Foreigner In Malaysia. This kind of demand raised on the person is known as Tax on Regular Assessment.

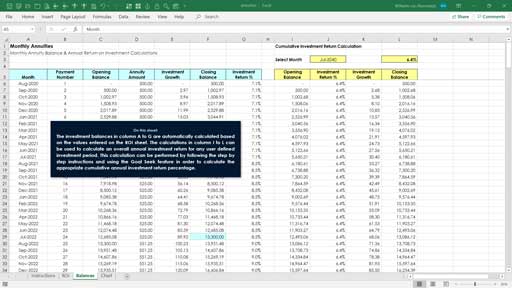

Personal Income Tax Malaysia Guide For Ya2020 Excel Template Included Life Of A Working Adult

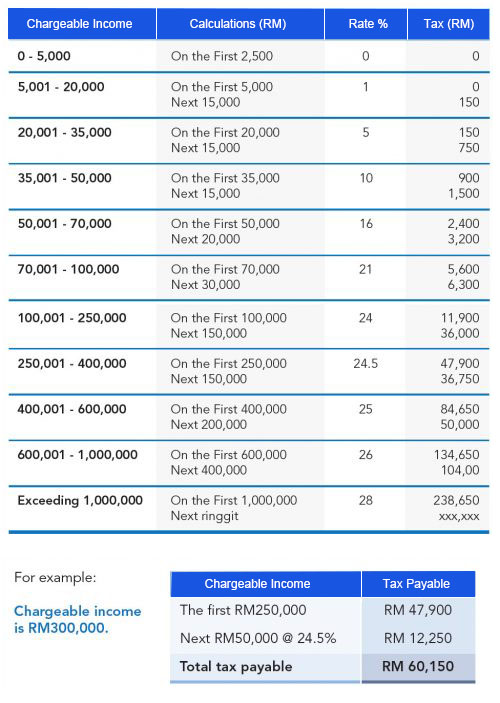

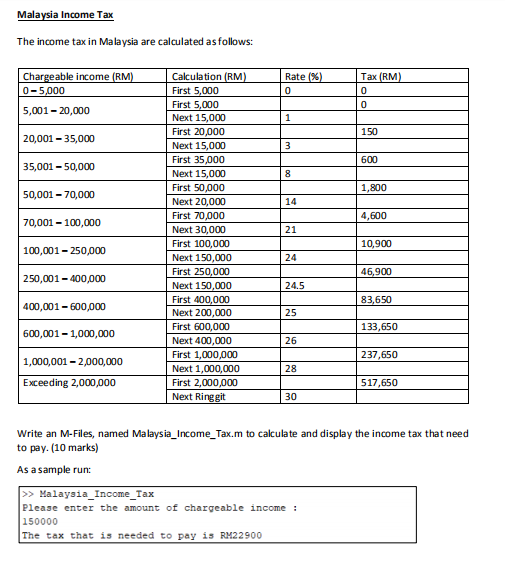

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

How To Calculate Rental Income Tax For Non Residents Foreigner

Income Tax Computation In Excel Format 4 Suitable Solutions

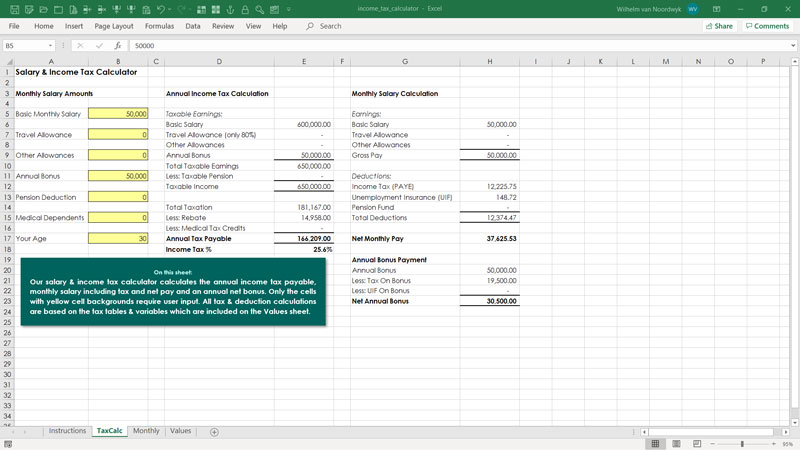

Computation Of Income Tax In Excel Excel Skills

Computation Of Income Tax In Excel Excel Skills

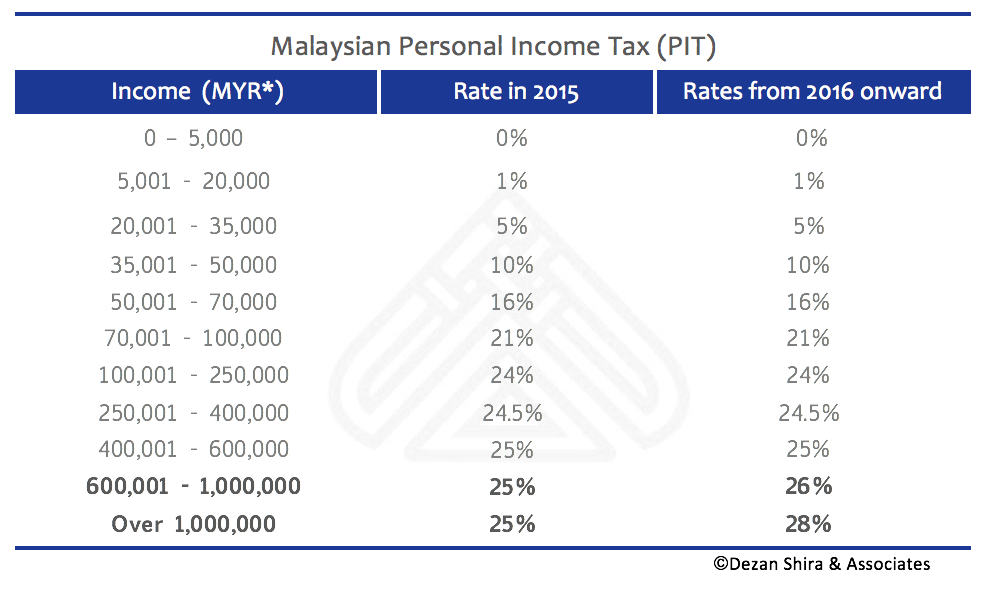

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

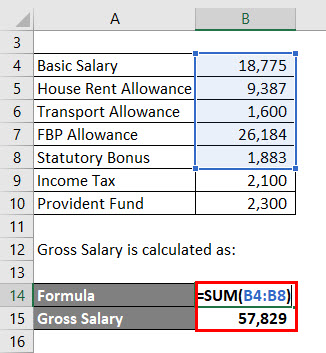

Salary Formula Calculate Salary Calculator Excel Template

2022 Malaysian Income Tax Calculator From Imoney

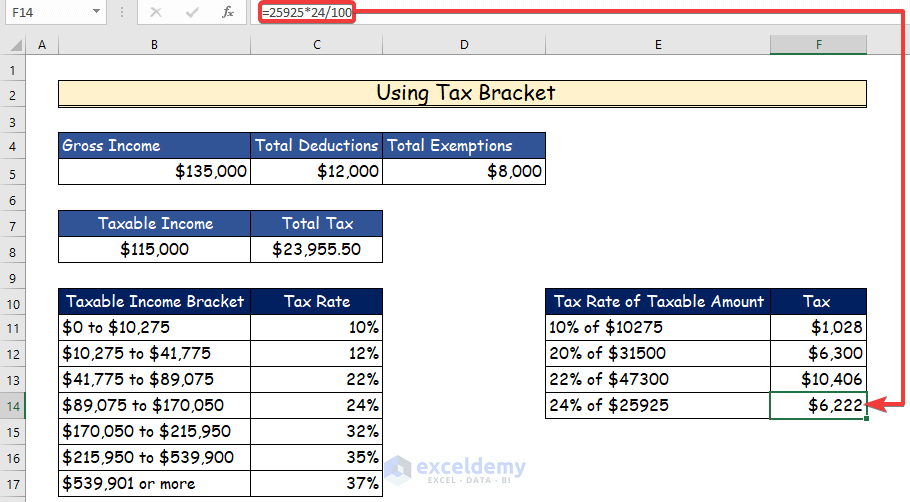

How To Calculate Income Tax In Excel

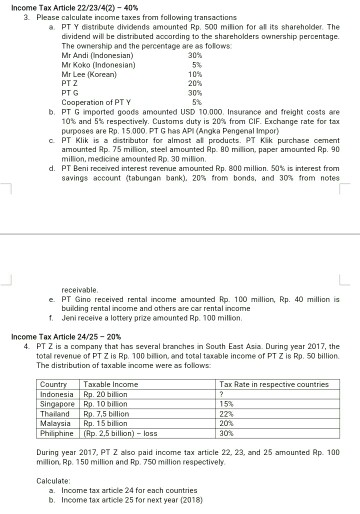

Income Tax Article 22 23 4 2 40 3 Please Calculate Chegg Com

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax Formula Excel University

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

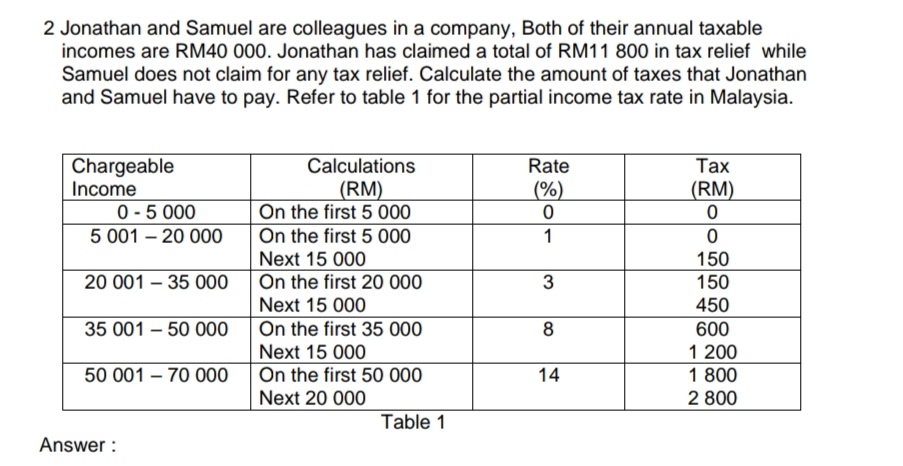

Answered 2 Jonathan And Samuel Are Colleagues In Bartleby

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Formula Excel University

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Comments

Post a Comment